san francisco sales tax rate breakdown

South San Francisco CA Sales Tax Rate. State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund allocations and to other local jurisdictions.

California Vehicle Sales Tax Fees Calculator

The estimated base pay is 84195 per year.

. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. San Francisco suffered the worst drop in sales taxes in California this year even after businesses began reopening and may have also suffered a drop in. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. With local taxes the total sales tax rate is between 7250 and 10750. The sales tax amounts in the interactive map above represent only the collections attributable to local Bradley-Burns portion of sales tax from 2011 to 2016.

What is the sales tax rate. City of San Leandro. Sales tax is 85 percent.

Sales Tax Rate plus applicable district taxes Prepayment of Sales Tax Rate per gallon Excise Tax Rate per gallon 072021062022. Assessment of the Sales and Use Tax on Purchases. The average homeowner pays just 073 of their actual home value in real estate taxes each year.

Sales tax may be added to the cost of buying goods and services at US retail locations. File Monthly Transient Occupancy Tax Return. Presidio San Francisco 8625.

Ad Find Out Sales Tax Rates For Free. Some 45 states plus the District of Columbia use state-wide base sales tax rates - while there are 5 states with no sales tax at state level. Fast Easy Tax Solutions.

In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes. California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. The estimated total pay for a Tax is 100864 per year in the San Francisco CA Area.

San Mateo County This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax 942. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. 4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax.

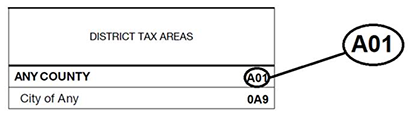

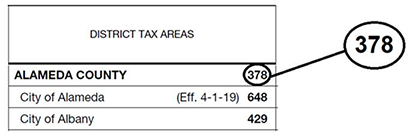

District tax areas consist of both counties and cities. The current total local sales tax rate in South. The Golden State fares slightly better where real estate is concerned though.

The partial exemption rate is 39375 making partial sales and use tax rate equal to 45625 for San Francisco County and 53125 for South San Francisco San Mateo County. The December 2020 total local sales tax rate was 9250. The 9875 sales tax rate in South San Francisco consists of 6 California state sales.

The amount paid varies by locality. For a full historical description of sales tax rates and beneficiaries in San Francisco and. Some areas also have local sales tax rates on top of these charges.

City of Union City. Presidio of Monterey Monterey 9250. The San Francisco County California sales tax is 850 consisting of 600 California state.

The state tax rate the local tax rate and any district tax rate that may be in effect. Hotel fees in San Francisco include 14 percent occupancy tax and 115 percent Tourism Improvement District assessment depending on the location of the property. Over the past year there have been 58 local sales tax rate changes in California.

California has recent rate changes Thu Jul 01 2021. 3 rows Sales Tax Breakdown. The transient occupancy tax is also known as the hotel tax.

Select the California city from the list of cities starting with A below to see its current sales tax rate. The sales and use tax rate is determined by the point of delivery or the ship to address. This page will be updated monthly as new sales tax rates are released.

This number represents the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. 4 rows Sales Tax Breakdown. The sales and use tax rate in a specific California location has three parts.

The estimated additional pay is 16669 per year. A base sales and use tax rate of 725 percent is applied statewide. There may also be more than one district tax in effect in a specific location.

Alameda County Ca Property Tax Search And Records Propertyshark

Food Truck Cost Spreadsheet Startup Business Plan Template Food Truck Cost Startup Business Plan Template Startup Business Plan

Save Money Effortlessly Through Digit Really Yes Really Enemy Of Debt Extra Money Saving Money Debt Management

/roaring-twenties-4060511_final-238cf76a01444341a1109cd2dd3a7023.gif)

1920s Economy With Timeline And Statistics

How Much Should I Set Aside For Taxes 1099

California Vehicle Sales Tax Fees Calculator

Full List Sales Tax Increase Now In Effect Across California Kron4

Property Tax How To Calculate Local Considerations

Data Shows Steep Drop In Sf Sales Tax Revenue Possible Decline In Population The San Francisco Examiner

Redefy Real Estate Housing News 8 15 16 Nar National Average For Real Estate Real Estate Realtors Home Buying

The Average Percent Of Income Donated To Charity Can Improve

Information For Local Jurisdictions And Districts

Information For Local Jurisdictions And Districts

File Southdakota Stateseal Svg Wikipedia The Free Encyclopedia Us South Dakota South Dakota State North Dakota State Mottos